These 10 mortgage facts will give you an advantage when shopping for a home or refinancing an existing loan.

2. Different Lenders Charge Different Fees

3. Lenders Can Sell Your Loan to Another Bank

4. Your Middle Credit Score Matters

5. A Low Down Payment for a Mortgage is Possible

6. You Can Refinance Your Home Loan Anytime

7. You Can Get a Mortgage Loan After a Foreclosure

8. Good Credit Allows you to Get Better Mortgage Rates

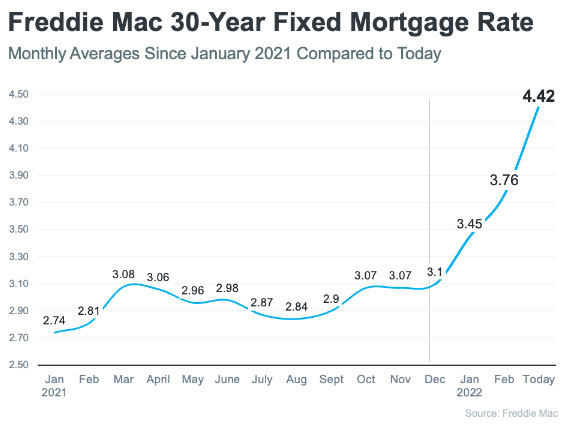

Just like the stock market, mortgage rates change throughout the day. The mortgage rates you see today may not be available tomorrow. If you are in the market for a mortgage loan, be sure to check the current rates being offered by lenders. If you have already researched and found your dream home, consider locking in your rate as soon as possible.

As you can see in the chart below from Freddie Mac, a 30-year fixed mortgage rate went from 2.74 in January 2021 to 4.42 in January 2022.

Don’t expect every lender to charge the same fees for a mortgage loan. Every lender structures their fees differently, so it is important to shop with at least three lenders to compare. Next time you apply for a mortgage loan, pay attention to the rates, points being charged, and closing costs.

Different lenders charge different fees because they have additional costs internally and take a risk when lending you money.

Many borrowers have experienced getting a mortgage loan with a particular lender only to find out that the loan has been sold to another bank. The reason why this happens is that lenders need to free up their liabilities to make room to give out more loans. Having your loan sold does not affect your mortgage whatsoever, but it’s important to pay close attention to your mortgage statement and any correspondence you receive in the mail to make sure you do not make payments to the wrong bank.

When you apply for a mortgage loan, the lender will pull your credit scores from three credit bureaus (Transunion, Equifax, and Experian) to help determine your creditworthiness. Your middle score of the three is what lenders will use for loan qualification. However, the underwriter will review all three scores as part of the loan underwriting process. If you pull your credit score through a website online, the credit scores displayed to you may be different from what lenders use because they use other reporting systems.

You don’t have to come up with a 20% downpayment to obtain a mortgage loan. You can get an FHA mortgage loan with a down payment of 3.5%. The VA and USDA loans required no money down. VA loans are reserved for military veterans and their families. USDA loans are typically used for rural or farming properties. A Conventional 97 Loan Program has a down payment requirement of only 3%. Freddie Mac and Fannie Mae also have loan programs that allow for a 3% down payment.

Take note that many lenders will require mortgage insurance for loans with less than a 20% down payment on a purchase loan or less than 20% equity available on a refinance.

You can refinance your mortgage anytime, but it doesn’t necessarily mean you should. Think about why you want to refinance. Is it because you want to lower your monthly payments, change the type of loan you are in or take cash out from your equity? Whatever the reason is, make sure that it makes financial sense.

You should note that some lenders have a six months waiting period if you want to refinance with your current lender. If you want a different lender, you don’t have to wait six months.

According to ATTOM, there were 151,153 U.S. properties showing foreclosure filing in 2021. There is good news for these borrowers because they can get a mortgage loan after foreclosure. There are waiting periods involved; for example, you must wait three years after a foreclosure to apply for an FHA loan. The waiting period is seven years from foreclosure if you want a conventional loan. For those seeking a VA loan, the waiting period is two years.

There are exceptions to the waiting periods, but you must show the lender that your foreclosure was caused by an event outside your control, such as losing your job or being seriously ill.

Good credit scores mean a better rate on any type of loan, especially a mortgage loan. Your credit heavily impacts the type of mortgage loan you will qualify for. To maintain a good credit report, make sure you monitor it closely. One of the advantages of good credit is that more banks will want to compete for your business, giving you leverage to negotiate closing costs.

Knowing your APR will allow you to see the true cost of your loan. While the interest rate shows the annual cost of your loan, the APR includes other fees such as origination points, admin fees, loan processing fees, underwriting fees, documentation fees, private mortgage insurance, and escrow fees.

More or fewer fees may be included in the ARP from what we mentioned. To be sure what fees are included in the APR, ask your lender to give you a breakdown of the closing costs.

One way to reduce closing costs is to have the sellers contribute towards the closing costs when purchasing your home. The buyer and seller can negotiate the closing costs in the purchase contract. The amount the seller can contribute will depend on the type of loan. Another way to save on closing costs is to have the lender give you credit to cover out-of-pocket loan costs.

Photo credit: Aleksandr Bondarev